Summary:

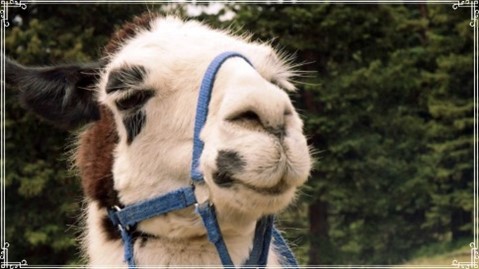

It’s not a typical scenario for a loan request involving a manufactured home on a parcel of land. It’s a unique bird, or in my case, a beautiful llama...

The Borrower's role is not only important, but also crucial.

They must own the land in fee and the manufactured home, a significant factor in the loan process. Ensuring the manufactured home is affixed to the ground with proper government certifications, making it real property, is paramount. This is not just a movable structure that can be hauled away with a crew aan nd an 18-wheeler, but a valuable asset they are securing. The Borrower's role also includes verifying the property’s suitability for their intended use, such as gardening and animal keeping, and ensuring the home is installed on a permanent foundation. This empowerment is key to their confidence in the process.

Is the manufactured home affixed to the ground with proper government certifications, making it a real property asset, or can it be hauled away with a crew and an 18-wheeler?

Or do they own the manufactured home on a land parcel owned by a third-party investor, with monthly rent required?

Article:

The mortgage broker, a key player in this process, is not just a facilitator but also a source of reassurance. The Playay plays a crucial role in helping the Borrower find the right lender, negotiate terms, and ensure all necessary documentation is in order. Their role provides borrowers with a sense of security and confidence throughout the loan process, reassuring them they are not alone in this journey. The broker’s expertise and guidance are invaluable in navigating the complexities of the loan process, helping the Borrower feel supported. The lender’s response is crucial.

The procuring mortgage broker:

My client has an accepted offer to purchase a property with a manufactured home on it, located on a 1/4-acre parcel with a fixed foundation. The property will be non-owner-occupied and made available for rental. Similar properties are in demand for their access to gardening for fresh food, the ability to keep a few animals on the property, and the perception of living off the grid. The prospective renter owns a llama named Doll, along with a few goats and chickens. They are excited to find a home for Dolly Llama, their pets, and the kids.

The lender responded:

The first question is whether the real estate is being purchased in fee simple or leased from a third party. When a modular home unit is owned by a third party on a leased parcel, the property is considered personal property.

The property is located on a paved street with access to water and electricity. The sewage connection is to a septic tank.

Is the land parcel in a community association of similar properties subject to rules, such as covenants, conditions, and restrictions? Does the community have written bylaws?

The Borrower should contact the building and planning department to verify that gardening and some animals are permitted on the property.

What is the description of the manufactured home, including size, age, and amenities, and is the home installed on a permanent foundation? Was the installation engineered and permitted by the local municipal building department?

The manufactured home will remain personal property in California until the owner applies for and receives a 433a permanent foundation certification. This certification ensures the home is installed on a foundation that complies with the California Code of Regulations, Title 25, Chapter 2, Section 1855. Obtaining this Certificate requires specific municipal approvals, which the Borrower should be aware of. The process outlines the steps for obtaining the certification. The completed certification is then recorded in county records and will be in a future title search.

Upon completing a loan transaction or conveying the property title, a title company will issue a title endorsement (ALTA 7). His endorsement is not only crucial but also informative. It ensures the reassignment of ownership of the manufactured home from personal to real property, a critical step in the financing process. It keeps you informed about the house’s status changes and provides a clear view of every step in the process. This endorsement ensures the loan is secure and the property is transferred correctly, providing you with peace of mind and confidence in your decision.

The successful completion of the loan transaction and the reassignment of ownership of the manufactured home from personal to real property, as evidenced by the ALTA 7 endorsement, are testaments to the thorough and secure process.

This process, meticulously designed to give you confidence and peace of mind, ensures that Dolly has a new home and that the loan arrangement is successful. It’s a journey that may seem complete. Still, the process is thorough andguides you every step of the way, ensuring your confidence and peace of mind.